Trading Strategies Long And Short

Trading Strategies Long And Short. Taking a long or short position comes down to whether a trader thinks a currency will appreciate (go up) or depreciate (go down), relative to another currency. It involves buying equities that are expected to increase in value and selling short equities that are expected to decrease in value.

The short put is the opposite of the long put, with the investor selling a put, or "going short." This strategy wagers that the stock will stay flat or rise Like the long call, the short put can be a wager on a stock rising, but with significant differences.

In the trading of assets, an investorEquity TraderAn equity trader is someone who participates in the buying and selling of company shares on the equity Furthermore, an investor can combine long and short positions into complex trading and hedging strategies.

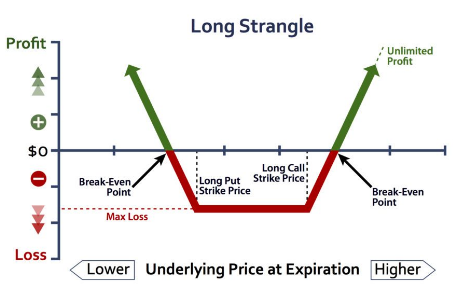

Goigng short means to sell without first owning. Know more about the trading strategies in the our knowledge base A Short Strangle Strategy can be highly profitable if used correctly. If our strategy doesn't perform well on the long or short side, then it's a good.

Komentar

Posting Komentar