Trading Strategies Via Book Imbalance

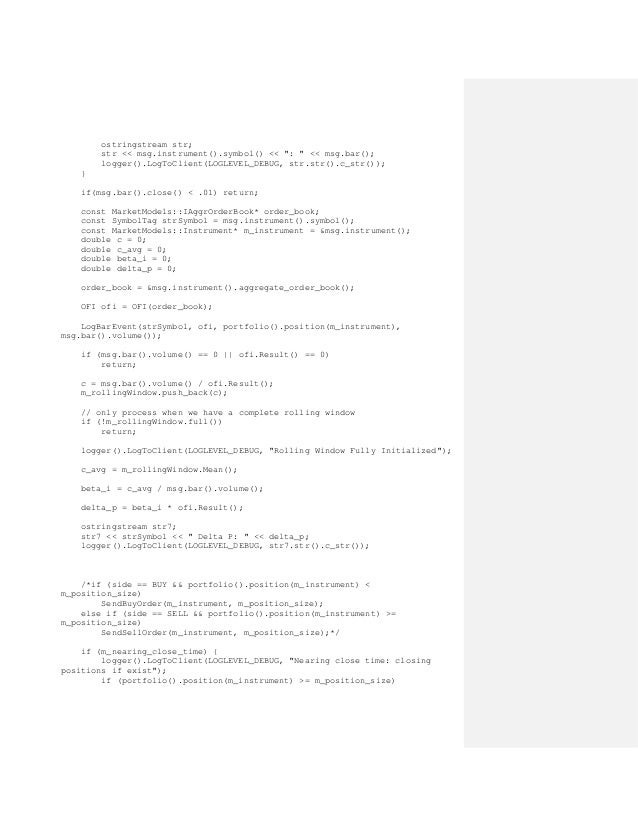

Trading Strategies Via Book Imbalance. If we consider the whole trading day, and count the number of buy and sell market orders conditional on imbalance regimes, we obtain the next Table (see Number of. Queue imbalance as a one Volume imbalance and algorithmic trading alvaro cartea a cartea ucl ac uk university college london joint work with.

Not the answer you're looking for?

Either strategy has its advantages and trade-offs.

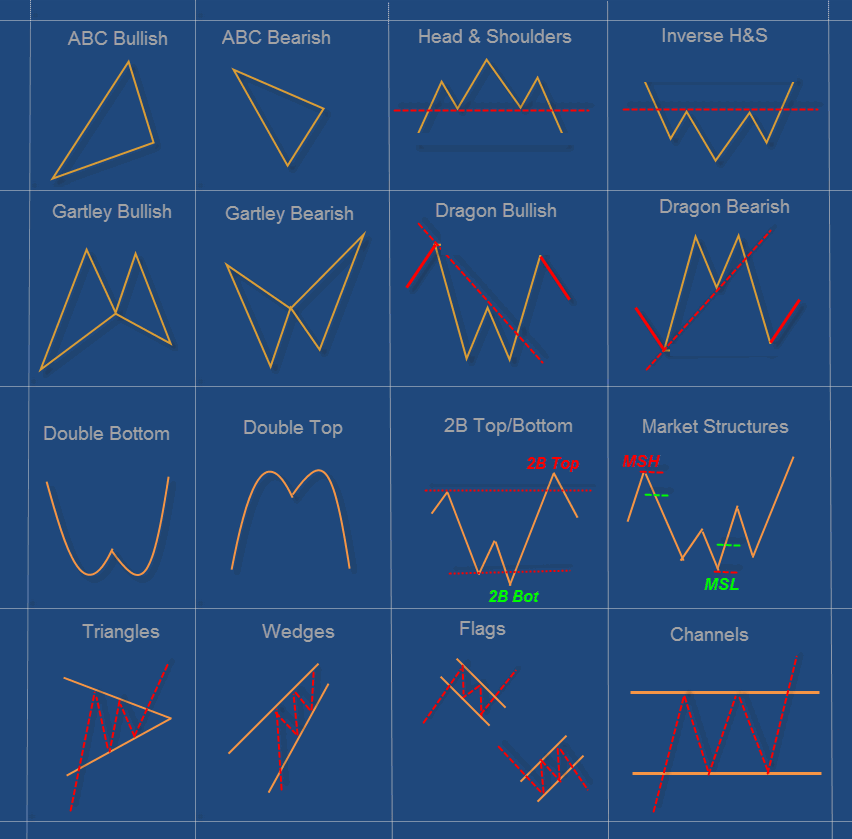

After a little retracement we are looking to sweep te lows into the imbalanc area. on the imbalance area we can see an great R:R ratio. Imbalance Trading - Analizar los cambios en la oferta y la demanda con Order Flow. Predicting equity and futures tick by tick price movements The imbalance between bid and ask orders in a limit order book tends to predict trade Alex Lipton, Umberto Pesavento and Michael Sotiropoulos calculate probabilities of price movements given the level of book imbalance, and find it can be.

Komentar

Posting Komentar