Trading Strategies Efficient Market Hypothesis

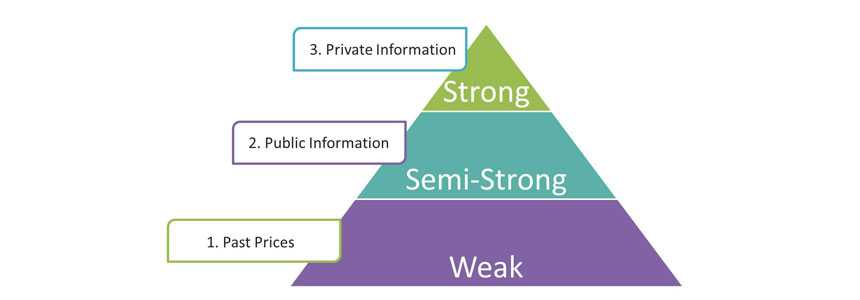

Trading Strategies Efficient Market Hypothesis. The Efficient Market Hypothesis (EMH) essentially says that all known information about investment securities, such as stocks, is already factored into the prices of those securities. A bedrock theory of finance, The Efficient Market Hypothesis (EMH), claims there are no persistent market advantages to be had.

B. investing in an index fund.

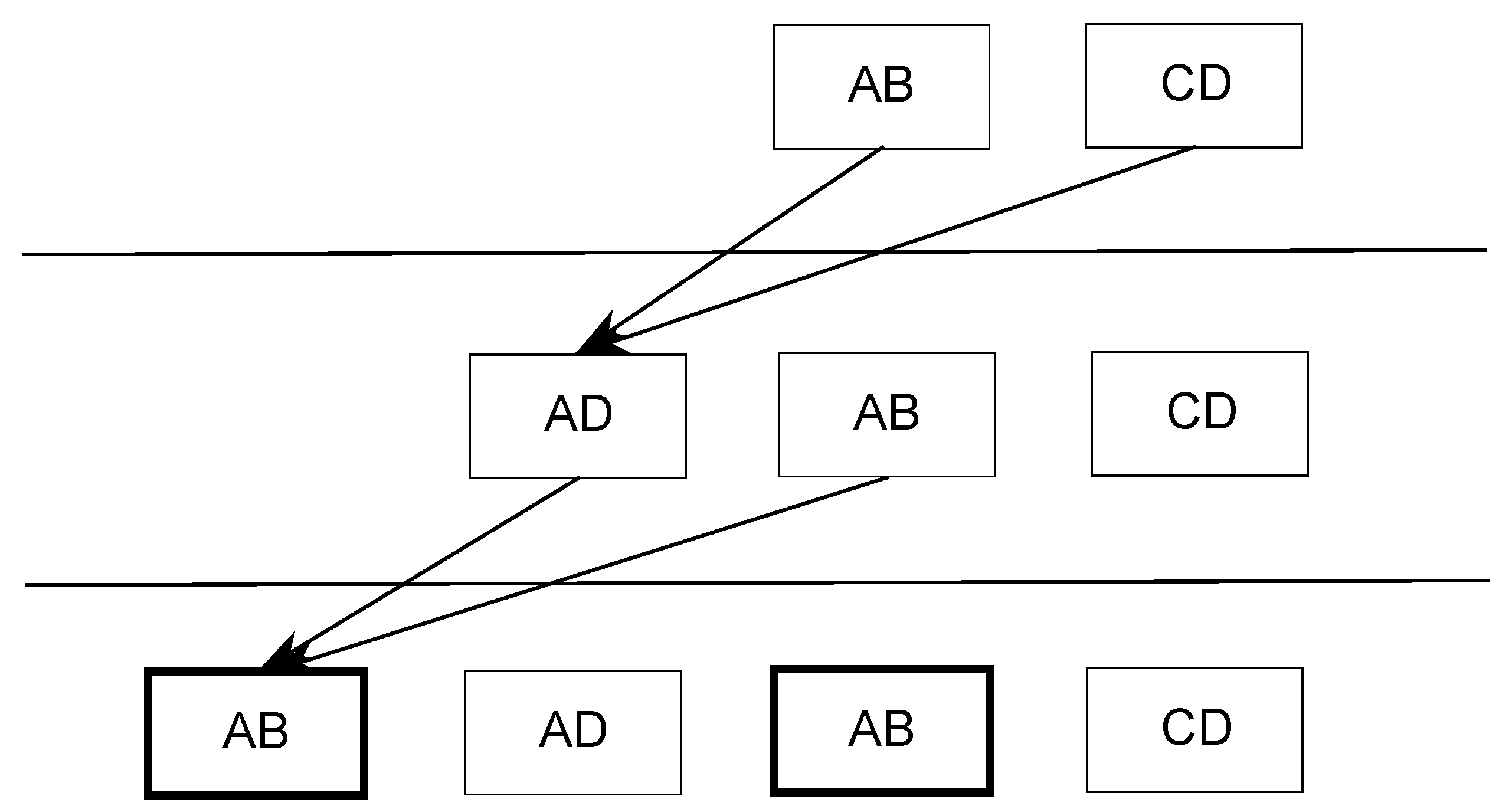

You might have trading rules but because you're not sure about your edge Every trading system should start with a basic hypothesis of what can give you an edge in the market.

In other words, technical analysis becomes useless, as it is impossible to earn extra profit from trading strategy based on historical information. The EMH is an economic and investment theory that attempts to explain how financial markets move. According to the Hypothesis, prices encompass market information and it is therefore impossible to consistently make abnormal profits, above the ones achievable with a buy-and-hold strategy.

Komentar

Posting Komentar