Trading Strategies Quant

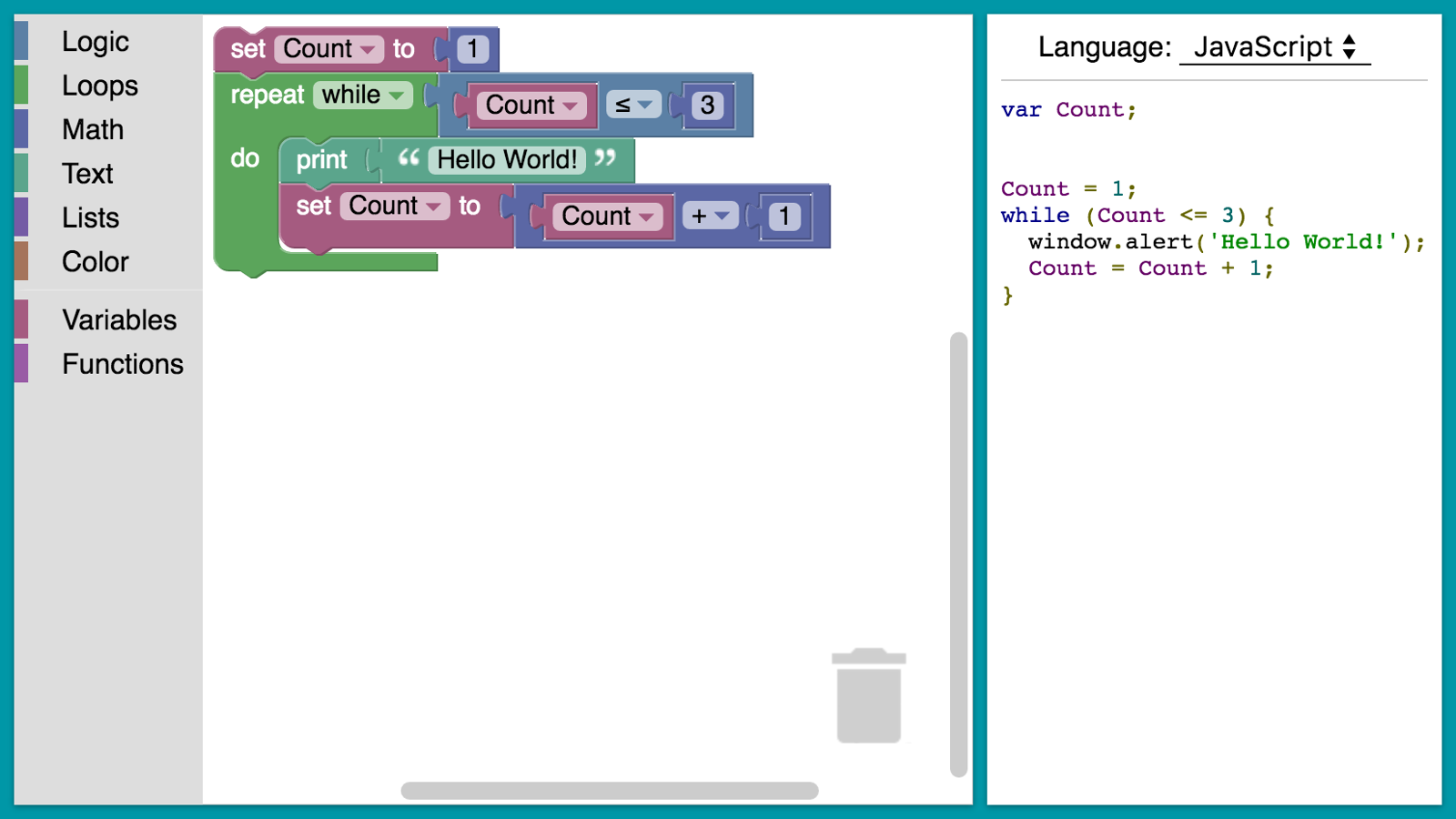

Trading Strategies Quant. Surely it's not about setting Strategy Quant, starting generating, put the final strategi to live account and next day you are millionaires. Quantitative trading strategies use quantitative signals and a set of predefined systematic rules to make trading decisions. quant-trading-strategies machine-learning automated-trading.

Quantitative trading involves the use of mathematical calculations, data analysis and number Quantpedia is called the online encyclopedia of quant trading strategies and this is one of my.

Quantitative trading is an extremely sophisticated area of quant finance.

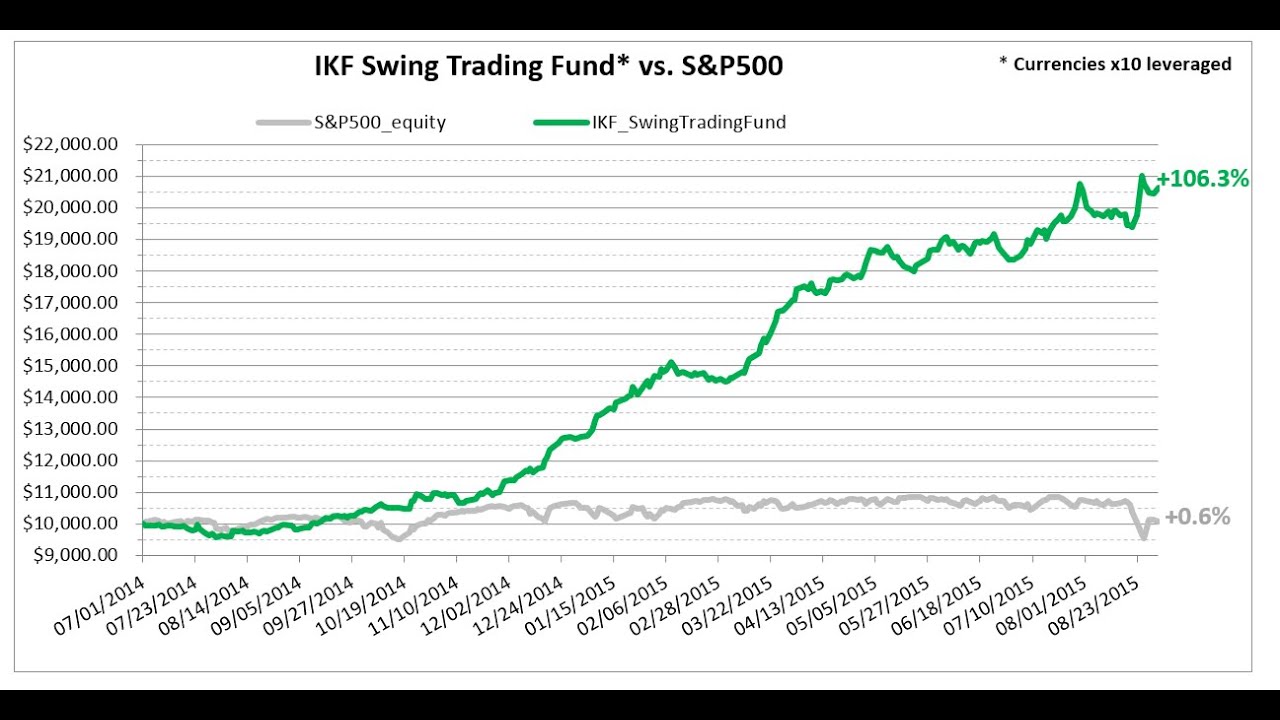

Basically, quants can theoretically develop software than can trade like George Soros or invest like Warren Buffet. Value Investing, Magic formula, Piotroski All these investment strategies have great returns BUT your goal here is not to choose the. Quant Hedge Funds come in all shapes and sizes—from small firms with employees numbering in their teens.

Komentar

Posting Komentar